March brought us the start of spring. These are the days that makes it worth it to live here in the Pacific Northwest. We might endure the long and gloomy days but the gorgeous days like the ones we have in March totally make up for it. We have more appreciation of nice weather and we were outside as much as we can utilizing our neighborhood playgrounds.

This month, MBP was invited to a birthday party with his friends at an arcade/bowling place. The kids got some cards to play with the arcade for a couple of hours, pizza and cake. We also went to a local high school for “Easter Egg”. The kids saw the Easter Bunny and some princesses.

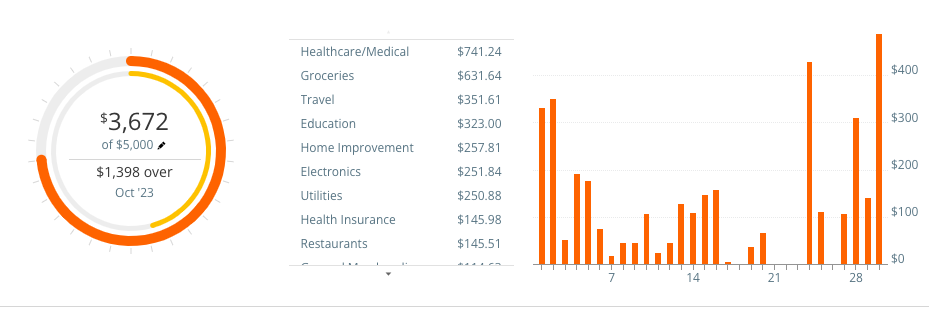

This month, we spent $3,912.8. Another month under $4k, which is good. Let’s take a look.

| Description | Amount |

|---|---|

| Groceries | 823.92 |

| Healthcare/Medical | 538.63 |

| Automotive | 447 |

| Education | 323 |

| Utilities | 306.99 |

| Kids Activities | 293.34 |

| Home Improvement | 289.14 |

| General Merchandise | 203.52 |

| Charitable Giving | 200 |

| Alcohol | 110.3 |

| Dues & Subscriptions | 104.21 |

| HOA | 84 |

| Restaurants | 69.68 |

| Clothing/Shoes | 33 |

| Gasoline/Fuel | 26.58 |

| Gifts | 20.13 |

| Mobile Phone | 17.2 |

| Pets/Pet Care | 14.16 |

| Travel | 8 |

| Total | 3912.8 |

Groceries – $823.92

Our grocery spending in February was low, so this probably average out with 2 months. We didn’t buy anything out of ordinary this month. We still shop at WINCO and Costco and hardly price compare.

Healthcare/Medical – 538.63

Mr. MMD got a new retainer. This is specifically fit him by his dentist. It cost $450. He also paid $50 deductible for his last dental cleaning. I paid $5 for my vision insurance and $33.63 for some lab exams. We paid our health insurance through a gift card by having enough rewards from preventative care. Our dental insurance was paid February.

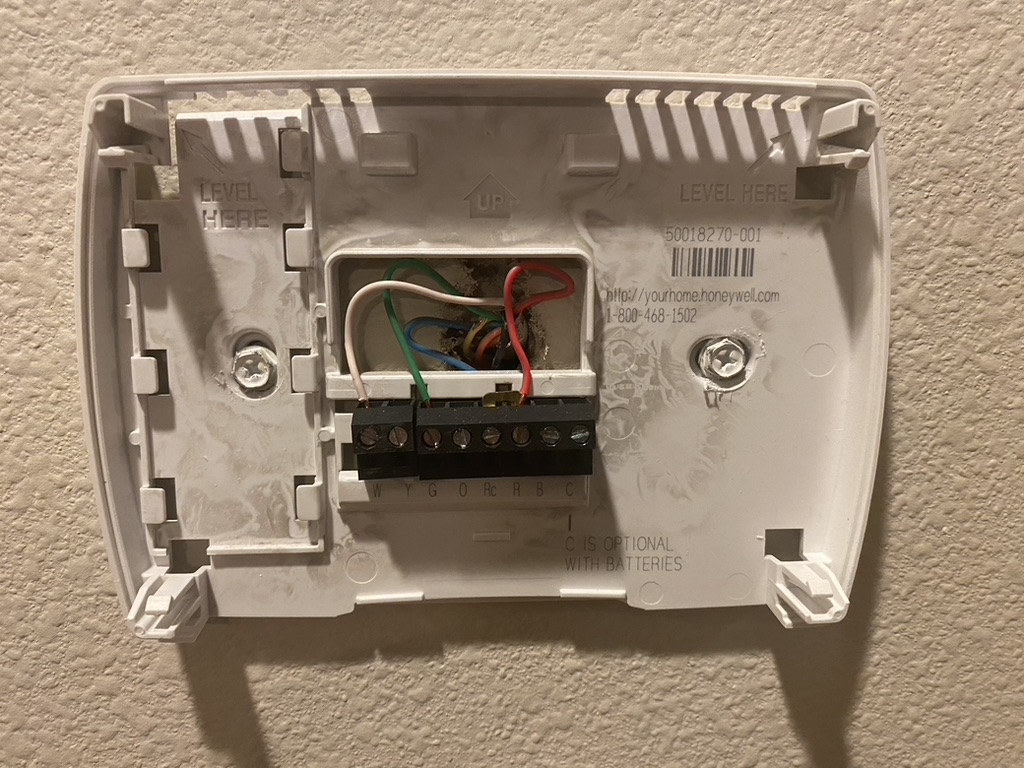

Automotive – $447

I switched from Geico to Progressive. The last bill from Geico was $673.37 for the same policy. We saved over $200 by getting other quotes. I thought about getting our insurance from Lemonade which charge you a “per mile” insurance. We might go camping this summer and might drive more. I ended up signing up for Progressive. The bill is the 6 month insurance for our 2011 Toyota Prius and 2011 Volkswagen Jetta. We only have liability and personal injury protection.

Education – $323

AHP’s preschool tuition. He goes 5 days a week for 3 hours.

Utilities – $306

Our electric and gas were $181.72. This should go down as the weather warms up. Our sewer is flat at $69.41 and water bill was $55.86.

Kids Activities – $293

I signed up MBP for a summer camp for a week this coming summer. We like to stay local to enjoy the glorious weather here in the Pacific Northwest, but it will be good for him to go to some camp at least for a week. I also got some stuff for easter from the dollar store for $19.16. We got the kiddos some items from the Scholastic Book Fair for $13 and lastly, we got MBP’s class some items requested by his teacher for $11.18.

Home Improvement – $289

Some more items for the yard, some wood for another planter and some plants from Costco.

General Merchandise – $203.52

Catch all from Costco and Amazon. These are items like toilet paper, paper towels, new pan or anything that we don’t want to categorize.

Charitable Giving – $200

Church offering for March. Both MBP and AHP joined me to church on some Sundays. They get a choice if they want to go. Sometimes they do, but sometimes they don’t.

Alcohol – $110

A wine for my book club and Mr. MMD’s liquor and beer from Costco.

Dues and Subscription – $104.21

I signed up for a year of ad-free HBO max. They are having a sale and I was able to avail a $25 statement credit from Chase. Total for the year were $89.96. Our Amazon prime were $7.65. I also paid for a month of Paramount Plus. I forgot to cancelled my free subscription.

HOA – $84

Our HOA fee to maintain the 20+ miles of trails and numerous playgrounds in our neighborhood. I’m still not a fan of HOA, but we uses the trail almost every day to go to school. We also definitely enjoy the playgrounds.

Restaurants – $69

We went to our local Diner after the easter egg hunt. The kiddos also visited the same place for some milkshakes on one sunny Saturday. Included here as well were MBP’s hot lunches for school. We started letting him having hot lunches from school once a month. I put in $11.25 on his account. This is about 3 lunches.

Clothing – $33

I got MBP new shoes from REI, which we might return. I’m still not sure.

Gas – $26.58

One tank of gas for our Prius.

Gifts – $20.13

A gift for MBP’s friend for his birthday.

Mobile Phone – $17.2

A gig of data for 2 lines from Xfinity Mobile. I just received an e-mail that this will increase soon.

Pets – $14.16

Our furbaby’s compostable poop bag.

Travel – $8

Deposit for our Catamaran Tour and Kualoa Ranch Tour for our trip to Hawaii.