Well this was a very late post, given that it is already end of March. I thought about stopping my monthly update since our last year’s expenses are surprisingly low. That said, I still find this update useful for me. I like looking back and comparing my finances and the updates of our early retirement life.

Life Update

In January, I turned 35. Woo hoo! I am officially on my mid thirties. It was a low key celebration with my family with some KFC and Boston Cake from Safeway. MBP love love birthday celebrations because he can blow the candles which he did on my cakes.

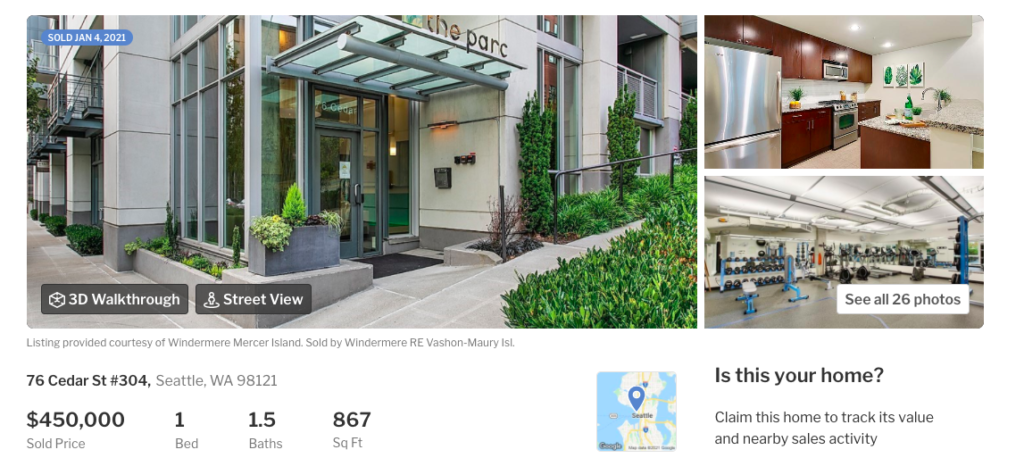

We also officially sold our rental property. The property is a 1.5 bedroom condo in Seattle. All the proceeds excluding taxes were invested on VTI. I also gifted my Volkswagon Jetta to my sister. I bought that car in 2010 and put in about 50K miles. I haven’t driven that car for the entire 2020 and barely driven it in 2019 after retirement. We have to buy a new battery because the it was dead. We also changed all 4 tires before giving it to my sister. She reimbursed for all maintenance cost and administrative cost. We are now a one car family, until we buy a van in the near future.

Spending

We spent $2,045.47 this month! This is actually lower than I thought!

Health insurance premiums are going to be a big expenses this year. There was some back and forth for the kids insurance until I finally got clarity. We opt out for dental care insurance and plan to pay for it out of pocket.

Food is next category that we spent on. I started accounting for all the junk foods that we’re buying, because I really want to stop eating them!

We paid MBP’s tuition fee for the rest of the year and continued to add on to his 529 plan. We will start contributing to AHP’s plan around May.

Utilities this month were for sewer, internet, electric and gas, and our mobile phone. Our electric and gas are low because I accidentally prepay it the previous month.

Our housing expenses consist of HOA dues, furnishings and household supplies. We went to Ikea in January and I’m pretty sure we bought items for the kids but I can’t recall.

The rest are pretty straight forward below and all under $100.

| Description | Amount | Comments |

|---|---|---|

| Health Insurance | 707.15 | Bronze plan for myself and the Mr. |

| Groceries | 530.88 | |

| 529 College Fund | 200.00 | |

| Preschool Tuition | 168.00 | MBP's tuition for the whole year. It is very affordable because it is a coop |

| HOA Dues | 73.00 | |

| Fast Food | 70.99 | Run to KFC for my birthday and a Burger King trip |

| Sewer | 60.16 | |

| Pet Food & Supplies | 57.47 | |

| Internet | 45.00 | |

| Electric and Gas | 38.93 | |

| Furnishings | 33.51 | Something from Ikea - which I think are gifts for the kids |

| Junk Food | 24.47 | I started accounting for all the junk food that we are eating! |

| Gas & Fuel | 21.26 | |

| Pharmacy | 16.38 | |

| Mobile Phone | 16.31 | |

| Household Supplies | 10.92 | |

| Entertainment | 10.91 | |

| Alcohol & Bars | 10.00 | |

| Subscription | 6.55 | |

| Books & Supplies | 5.00 | Library fine for the books that I apparently lost. I swear I returned it. |

| Hobbies | 1.88 | Cost from Google Cloud Platform to host this blog |

| Shopping | (76.57) | I returned some items to Amazon so this is negative |

| Grand Total | 2,045.47 |