I’m not burying the lead here. I got sick which lasted all June and early July. The illness and the busyness of summer means that I didn’t get the chance to write. I spent a lot of my time in our bedroom or our couch last June. I’m thankful that I have an energy now and feel somewhat normal.

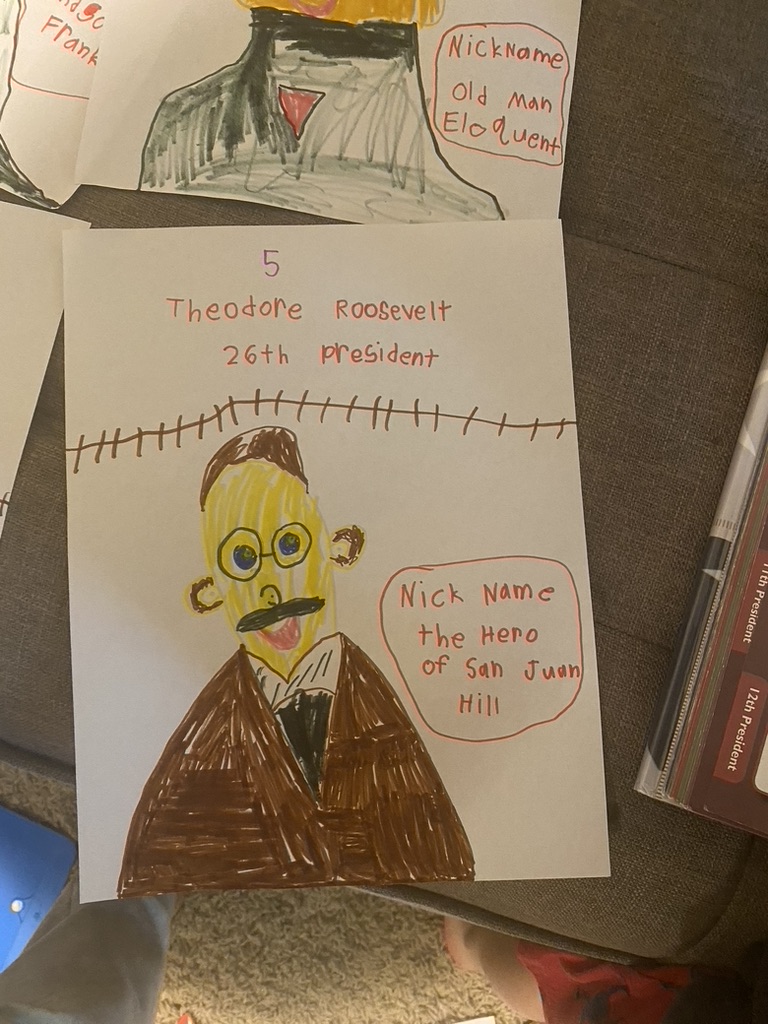

The month of May was spent getting back to our routine. It was the last full month of school for the kids. They also of course got some nasty virus, but they ended the month with just a little cold. My kindergartner had an art program in his school, run by the PTA and I volunteered for that. It was a great program. I’m really glad that our local school have a good PTA events.

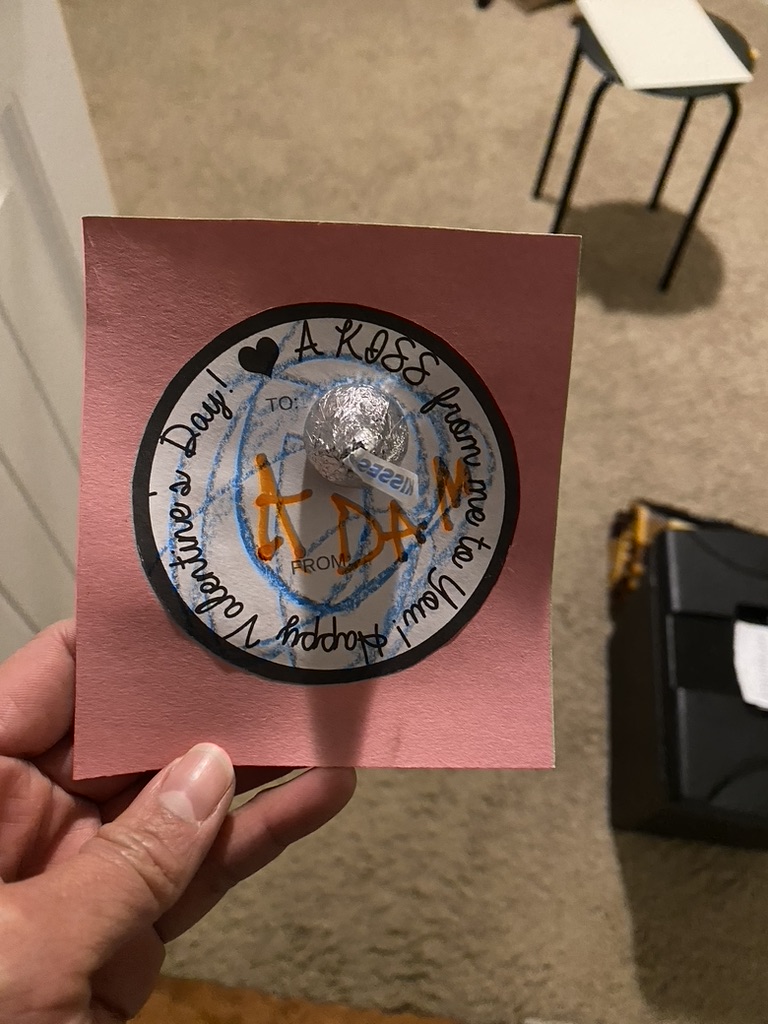

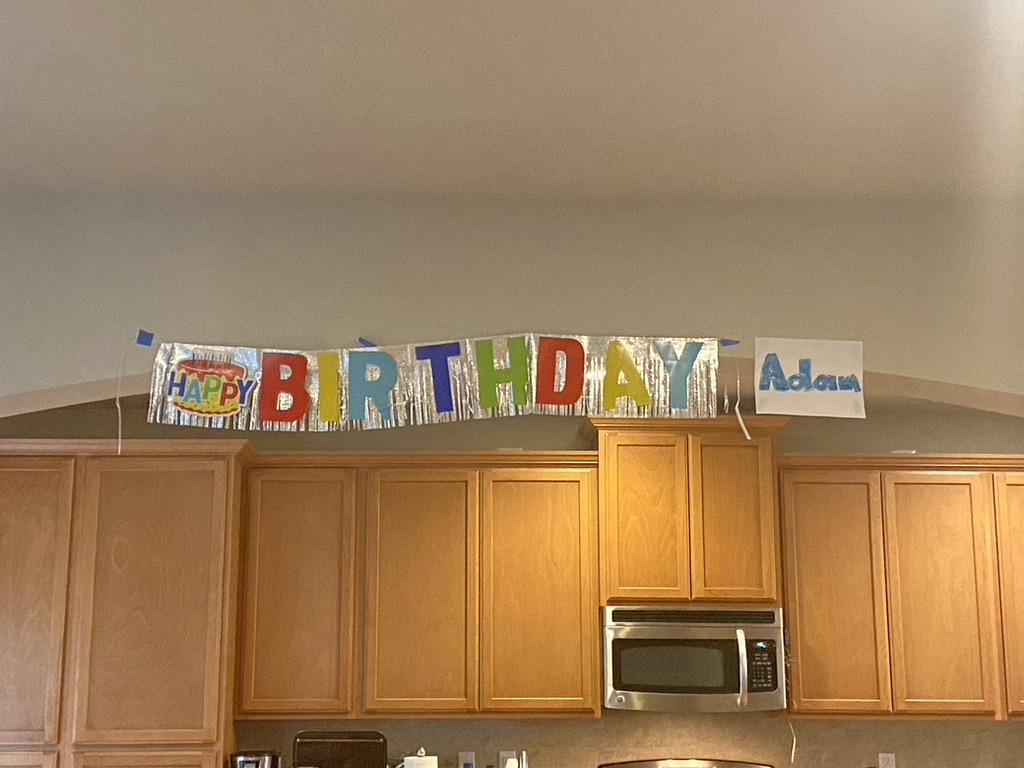

We also went to birthday parties, and celebrated Mr. MMD’s birthday. The boys got him some sunglasses that we got from our neighborhood garage sale. For Mr. MMD’s birthday, we went to Chipotle, which is an upgrade from the previous year’s Taco Bell Celebration. We then top it off by going to Menchies for some frozen yogurt. Our May ended with a Spring Kindergarten concert and trip to the movies to watch Garfield with our Campfire friends. I finally used the Fandango gift certificate that my sister gave me last Christmas. Movie tickets prices are nuts these days.

I experienced some flu like symptoms early June and some fatigue, which lasted for almost a week, and then I experienced some joint pain and rashes. I went to urgent care twice this month and have seen a doctor twice. Apparently, I got the 5th disease. This is very common for kids and is consider a minor disease. AHP showed a slap cheek the day after I went to urgent care and his pediatrician diagnosed it based on my symptoms. I had multiple blood drawn because the doctors thought that it was some kind of auto immune disease. Good thing that my second blood test showed the 5th disease infection with my other inflammatory marker back to normal. I was still able to chaperone MBP’s class to his school field trip, attended a minor league baseball game for his school, planned and celebrated MBP’s 7th birthday party and attended both kids “graduation”. We have 1 more year of preschool for AHP and MBP will start 1st grade this September. Time is flying by so fast. Days are long but years is like a blink of an eye. I teared up on both graduation days. I’m definitely very thankful that we have the time to be with the kids day to day.

Just the day after the kids last day of school, my in-laws arrived for their yearly summer visits. They came while I’m sick so it was nice to have some help with the kids during the start of their Summer break. I was still able to go out with them and took the kids to some outings. There were visits to Chuck E Cheese, bowling, Super Jumps and neighborhood playgrounds. Our neighborhood had an annual Luau event and it was a good afternoon. We also went to the annual Rhubarb fest and had our annual Rhubarb Pie.

Mr. MMD and my father in-law also started on our built ins in the playroom. It was our most used room so I was worried that it will be out of commissioned for a long time. Mr. MMD worked really hard and it was built in just 2 weeks. We even had the carpets steamed. It was great and definitely more functional.

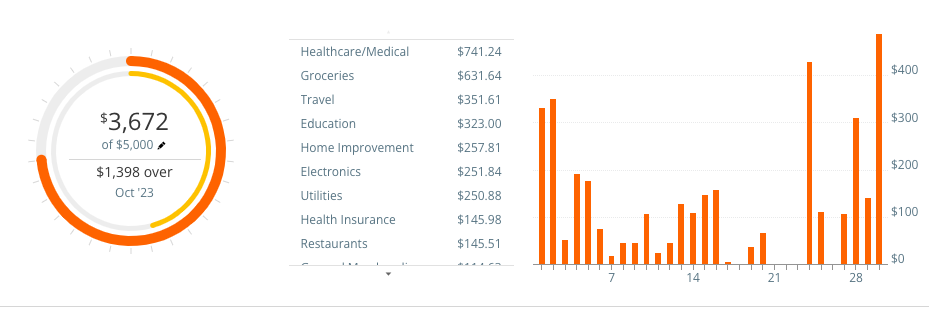

Onwards to our spending. We spent $13,288 for the month of May and June. Wowza! We had a surprisingly low expenses from the last 4 months of the year so it is not surprising that it is this high. We also had some annual expenses that happened during these months. So let’s take a look

| Category | Amount |

|---|---|

| property tax | 3,149.80 |

| Home Improvement | 1,605.23 |

| Insurance | 1,420.56 |

| Groceries | 1,393.35 |

| Home Maintenance | 1,076.60 |

| Utilities | 693.23 |

| Education | 677.00 |

| Healthcare/Medical | 667.73 |

| General Merchandise | 623.27 |

| Kids Activities | 403.96 |

| Automotive | 201.00 |

| Charitable Giving | 200.00 |

| Entertainment | 199.63 |

| HOA | 168.00 |

| Gifts | 164.22 |

| Restaurants | 163.57 |

| Clothing/Shoes | 124.30 |

| Gasoline/Fuel | 110.00 |

| Pets/Pet Care | 82.54 |

| Travel | 53.78 |

| Mobile Phone | 29.12 |

| Internet | 28.07 |

| Alcohol | 20.35 |

| Business Miscellaneous | 17.88 |

| Dues & Subscriptions | 15.30 |

Property Tax – $3,149.8

This is our first installment of our annual property tax for our house. Our state tax is based on the value of our home and it just so happen that we live in a HCOL area. We have the smallest and cheapest house in our block. Our second installment is due in October.

Home Improvement – $1,605.23

We bought 2 cabinets for our built ins and of course the materials and equipments to make it. There will be some more items this July as we finished the project.

Home Insurance – $1,420.56

This is for our annual home insurance. It just keeps on going up.

Groceries – $1,393

A typical groceries for 2 months. We also discovered an Indian grocery store and managed to get our spices cheaper. We typically order it from Amazon for twice the price. This is actually lower since my in-laws paid for our groceries when they were here. I don’t think twice on spendin

Home Maintenance – $1,076

We bought 2 appliances. Mr. MMD bought a Sebo Felix Vacuum from a local store and it cost us $769.6. We’ve been using our Dyson for more than 7 years now and it never does a great job on getting our dog’s hair. I can definitely noticed the difference using Sebo. It is pricey but hopefully should last us another 7 years. We also bought an air purifier from Costco. We had a year with some haze and smoke due to fire and we want to be more prepared for that in case it happen again this year.

Utilities – $360.98

These are for 2 months of water, sewer, electric and natural gas and 1 month of garbage. Our electric should be higher in the coming months as I switch our heat pump to cool. We’ve been using our A/C this time. I’m researching on steps to move to induction oven and hopefully get it converted before the year ends.

Education – $677

Two months of AHP’s preschool tuition. We have a break for the summer, but then, MBP are enrolled on camps, but those are on kids activities.

Healthcare/ Medical – $667

Our health insurance and co-payments. The big one is my allergy test that was not covered by insurance, followed by co payments from doctor visits and payment for some lab test. I’m hoping that we can get reimbursement from the lab payments as well.

General Merchandise – $623

Our catch all items coming from Amazon, Walmart and other items. It would be interesting to see the total amount we spent on these items by year ends.

Kids Activities – $403

Basketball camp for MBP and Tee-ball for both MBP and AHP. Mr. MMD is coaching their teams and it is so fun to watch, but also exhausting.

Automotive – $201

We got a ticket for speeding on a school zone. Apparently Mr. MMD is going over 20 MPH while the school zone light is flashing. The camera caught it and the city sent us a $200 bill. I didn’t bother contesting it. I paid online with a $1 fee to pay electronically.

Charitable Giving – $200

Entertainment – $199

Popcorn for movies. Mr. MMD also took MBP to watch the Storms Game. He also went to a woodworking workshop.

HOA – $168

2 months of our HOA bill.

Restaurants – $163

Wow — we actually ate out. This is for our dinner out at Chipotle for Mr. MMD’s birthday. He also met up with a friend in Seattle for brunch. I attended my first FI meetup as well. We also took the kids to Menchies, McDonalds and Wendys. We are loosening up on this spending. It’s good. We just discovered a good Indian restaurant close to us and I would definitely visit again.

Clothing/Shoes – $124

I bought some items from REI, but ended up returning it. I also got the boys some down jackets from eBay. Mr. MMD bought some new pants from GAP and I got MBP and AHP some clothes at Goodwill. MBP is getting into all kinds of sports and wanted some jerseys. I found a Golden State Warrior Jersey, a Washington football shirt for $3.99. I also got the boys some shirts for 4th of July.

Gas – $110

Four trips to Costco for gas.

Pets – $82.54

We got our furbaby her food from Chewy.

Travel – $53

I got AHP a Kindercone Sleeping bag from REI. I purchased a gift card from Raise to stack up some discounts.

Mobile Phone – $29

We are still using Xfinity Mobile.

Internet – $28

This is for 2 months of internet.

Alcohol – $20

Mr. MMD met up with a friend for drinks.

Dues and Subscription – $15

Two months of Amazon Prime.

Gifts – $164

We got $150 of Amazon Gift Card as gifts for the kids teachers. The rest are for birthday parties.

Misc – $17.88

Annual renewal of this domain and a $5 annual fee for a meet up group.

We had one of our worst months this year, health wise. I was overwhelmed and cried, but it also made me appreciate the good days and the life that we have. We are lucky and I’m grateful that I have the time to recover at home with my family.