We wrap up 2023 with some traditional and low key celebrations here at home. Although it is enticing to go elsewhere and escape the gloomy weather, we prefer to stay home and have our annual traditions, celebrating Christmas here with our family.

The month didn’t necessarily start well. I experienced another bout of pink eye. I was quarantined for almost a week in the room to prevent the kids from getting it. Luckily none of my family members got it. Just after that, Mr. MMD were out of commissioned for almost a week with some cough and chills. At first, I thought it was COVID, but luckily it wasn’t. It still didn’t feel good.

The kids, luckily didn’t get anything aside from some snot and mild cough. At home, they opened their lego Advent calendar and we light up our Menorah for the Chanukah. We put up the Christmas tree, played dreidel and listened to a lot of Holiday Favorites through Alexa. During the start of the break, we drove north and saw the Snowflake Lane in Bellevue. Similar to last year, we made a day out of it and went to Children’s Museum. This year, we also went to a toy store and the boys got something from us. Usually, we eat out at Cheesecake factory, but since this is the first day of the break, it seems that half of Seattle thought the same. We ended up eating an overpriced Greek food inside the mall. AHP was disappointed because he LOVE cheesecake, but luckily he was ok with it. We also got them an overpriced light up balloon, which broke the next day. Now, they know that we will no longer be buying those things next time. I also know to make a reservation at Cheesecake factory next year.

Aside from Holiday festivities, I also attended my book club and started tax training for the upcoming tax season. Similar to last year, I will be managing a tax site and prepare taxes for low income folks. I’ll only be working for 4 hours, 2 days a week. I usually clock in more hours and try to help out during busy times. It was a very rewarding experience. It’s not something that I do for a paycheck, but I do cash it.

For this month I will write about our total expenses for the year, instead of our monthly expenses. I’m still getting used to Empower to track our expenses. I’m not sure if I like it, but I’m giving it a try. For this annual expense, I used Mint, probably for one last time.

In total, we spent $81,511.22. We spent 9% more or $7,582.69 more than 2022. I want to say that we loosen up on spending this year, but this is probably more normal. There were one time expenses, like putting up a heat pump but you can say that every year. Our house is 10 years old. I expect that we will need to replace some appliances starting next year. We also spent more on travel this year. We went on Alaskan Cruise and visited almost every theme park in Southern California. This is a lot different than our camping trips in 2022 and significantly more expensive. We also live in a state with high cost of living. Even day to day expenses are just more expensive in general.

Alright, so where did our money went and how did it compare to last year?

| CATEGORY | 2022 Spending | 2023 Spending | Difference | % Difference |

|---|---|---|---|---|

| Home | $2,126.21 | $21,143.00 | $19,016.79 | 894% |

| Food & Dining | $10,483.75 | $11,350.11 | $866.36 | 8% |

| Travel | $2,405.73 | $6,809.96 | $4,404.23 | 183% |

| Gifts & Donations | $6,114.80 | $6,623.83 | $509.03 | 8% |

| Taxes | $27,224.42 | $6,231.80 | ($20,992.62) | -77% |

| Health & Fitness | $4,743.79 | $6,058.13 | $1,314.34 | 28% |

| Kids | $5,317.24 | $5,851.43 | $534.19 | 10% |

| Auto & Transport | $3,527.41 | $5,323.57 | $1,796.16 | 51% |

| Bills & Utilities | $4,333.60 | $4,163.80 | ($169.80) | -4% |

| Shopping | $3,102.42 | $3,581.79 | $479.37 | 15% |

| Pets | $1,620.28 | $2,775.09 | $1,154.81 | 71% |

| Fees & Charges | $954.74 | $476.73 | ($478.01) | -50% |

| Business Services | $40.56 | $444.15 | $403.59 | 995% |

| Personal Care | $468.92 | $399.55 | ($69.37) | -15% |

| Entertainment | $1,464.66 | $278.28 | ($1,186.38) | -81% |

| Total | $73,928.53 | $81,511.22 | $7,582.69 | |

Home – $21,143

This is the highest category of our spending this year, up by $19,016.79 from last year, an 894% increase. This year, we installed a new heat pump, added a shed in our backyard and bought a new couch, a new latex mattress and a new queen size bed. All of it definitely add up. That said, we also use all of it on a day to day basis. There were some small items we bought this year like 2 apple trees and 3 blueberry bushes. The rest are annual items like home insurance and HOA dues.

Food & Dining – $11,350.11

This is $866.36 increased from last year or 8%. This is not bad, especially since this includes food and dining while we travel. Groceries clocked in at $8,857.27 for the year. We ate out more as well with $1,715.8 spent at restaurants and $541.46 at fast foods. Coffee shops were only $84.52.

Travel – $6,809.96

We spent more on travel this year with an increase of $4,404.23 or 183% increase from last year. Our travel is a little different this year. We went on Alaskan Cruise, which is not the cheapest. We also went to San Diego and visited a ton of theme parks and went back to Disneyland in the beginning of the year. I actually prefer this type of long vacations instead of 2-3 nights camping trips.

Gifts and Donation – $6,623.83

This also increased by $509.03 or a 9% increase from last year. $5k were our annual gifts to my parents and the rest are donations / gifts for Christmas. I do feel more generous this year. We are pretty fortunate, so it is good to share it.

Taxes – $6,231.8

At least our taxes decrease significantly by $20,992.62. We only paid for property taxes. In fact, we received a refund on our 2022 taxes.

Health and Fitness – $6,058.13

Our health and fitness spending increased by $1,314.34 or a 28% increase. I spent $1,183.2 on Eye care. I had a couple of bouts on pink eye last year, which leads to dry eye symptoms. I’m glad it was caught early, but I had a hard time finding an in-network eye doctor. Fortunately, I found one this year, and I’m hopeful that this eye issue will be fix. We were also a member of YMCA for about 9 months last year and spent $1,052.92 this year. We no longer have this membership, but will most likely return during the summer to sign up the boys for swim lessons. Our health insurance were $884.22 for the year. We signed up for a gold plan with a monthly premium of $99.58. We received some “rewards” by getting our annual exam and having some preventative care. We used those rewards to pay for some month’s premium. We just got more rewards which will pay for at least 3 months worth of premium this year. Mr. MMD went back to play hockey. We also have some various doctor payments from various visits with a total of $874.88. We paid more on prescription this year, with the biggest one being my eye drop for my dry eye syndrome. I am hopeful that this will go down eventually with our spending mostly focus on preventative items.

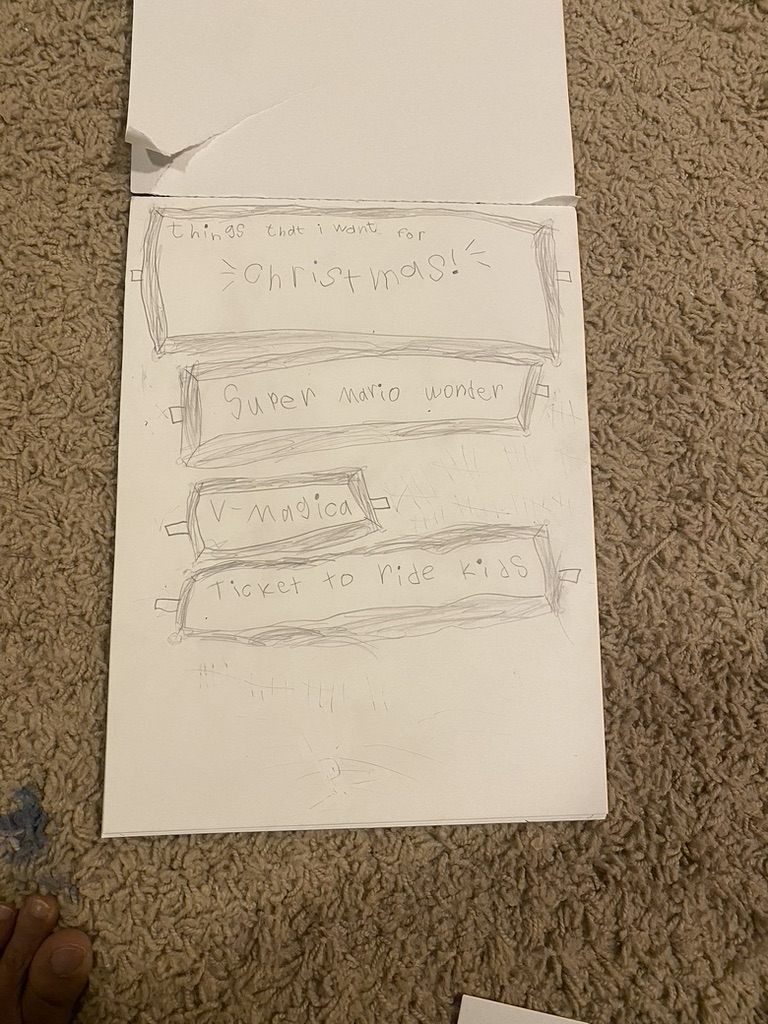

Kids – $5,851.46

This also increased by $1,314.34 or 10%. The biggest one is preschool expenses which is $3,056. We bought a fancy chair for AHP and a fancy bike for MBP. The rest are random items. This is pretty minimal. It might go down once AHP is in Kindergarten, but might also increase since they might be interested on more activities.

Auto and Transport – $5,323.57

We spent 51% more or $1,796.16 this year on our cars. Our 2 cars needed some service this year. The Jetta’s parking break got stuck while the Prius A/C needed some repair. Our 2011 Prius might also need some service this year as it reach 120k miles. This is our everyday car. I’m hoping that we can get another 5 years with this car before we need to get a replacement.

Bills and Utilities – $4,163.8

I’m surprised that this decreased by $169.8. A decrease of 4%. We installed Google Nest this year and a heat pump, so perhaps we are more efficient.

Shopping – $3,581.79

This increased by 15% or $479.37 more from last year. This is just various shopping items, include clothings and electronics.

Pets – $2,775.09

We spent $1,154.81, a 71% increase from last year. Our fur baby had her teeth cleaned and had tooth extract, which is basically the reason of the increase.

Fees and Charges – $476.73

This decreased by $478.01, a 50% decreased. We closed a couple of credit cards with annual fee. We are still earning points. Our flights and hotels in Hawaii for this spring break are all paid by points. I just keep earning, so we should have enough for more trips.

Business Services – $444.15

I spent $403.59 more this year because it is a renewal year for my CPA certification. I also pay for a CPE subscription to get my CPE hours.

Personal Care – $399.55

Some toiletries and haircut.

Entertainment – $278.28

Some games, movies, our state park passes, etc.

We spent more, overall, but nothing extravagant. Unfortunately, I had some eye issue that I’m still dealing with and our healthcare expense seems to be increasing over time. Perhaps, this is a good preview as we age. I’m hopeful that with the right lifestyle, this spending doesn’t increase over time.

We are coming on our 5th year of retirement. I no longer think about going back to work full time. I like the slow paced lifestyle. I still struggle with the gloomy weather and we still haven’t find a community here. COVID of course didn’t help as everyone stay in. I am just now meeting more people through the kid’s school and my book club.

Happy New Year! Here’s to hoping for a great 2024, better health, finding real friends and new experiences.