It was a busy, short month of February. We went on some play date in a trampoline playground. It’s basically one giant place for kids to jump around. It was packed and a bit intimidating for our kids. We also had a snow day during valentines day and it has been colder than usual here in the Pacific Northwest. I’m ready for Spring, but Winter never seems to end.

AHP also turned 3 this February. He was so excited for his birthday! He had school on the actual day and we brought mini cupcakes for the class. He also had a family celebration for the weekend and even had 2 cakes!

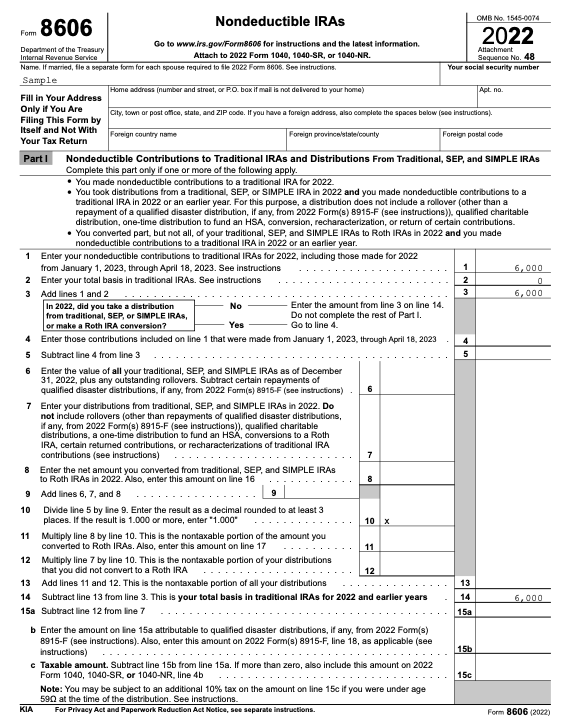

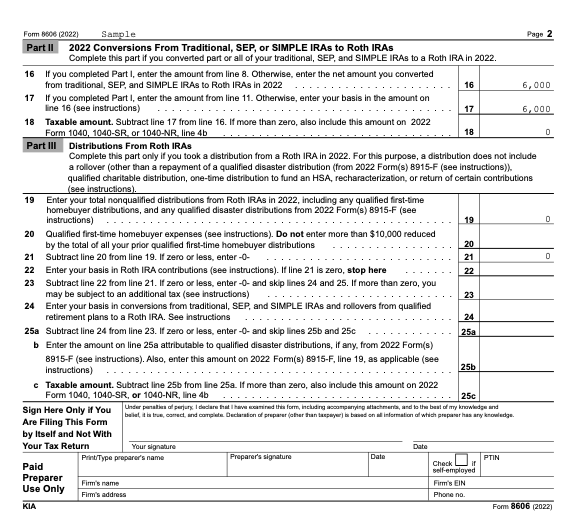

February was an expensive short month. In total we spent, $4,294.9.

| CATEGORY | Spending |

|---|---|

| Travel | $2,112.40 |

| Food & Dining | $738.33 |

| Pets | $410.03 |

| Kids | $300.00 |

| Bills & Utilities | $265.52 |

| Business Services | $249.79 |

| Health & Fitness | $230.75 |

| Home | $116.40 |

| Auto & Transport | $106.37 |

| Shopping | $18.10 |

| Total | $4,547.69 |

Travel – $2,112.4

We spent $1,996 for our upcoming 7 nights Alaskan Cruise this May. It will be our first ever cruise and I’m excited. Even the kids are excited. The cruise will tour Glacier Bay National Park. National Park Rangers will board the ship to give us a “tour” of the glacier. I read really good things about it. Since the tour will go to Canada, we decided to get passports for the kids. We paid $94 to the county for processing and kids passport photos. The actual application fees were cashed in March. I also paid $22.4 for 4 one way ticket to Florida this December during the winter break. I’m still unsure if the trip will happen, but I found a non-stop tickets to FLL, using Ultimate Rewards on Virgin Atlantic (via Delta). The ticket is refundable, so I have some time to plan.

Food and Dining – $738.33

Well, I thought this would be lower, given that we were using our Visa Gift Card to shop at Winco for groceries. We spent $585.88 on groceries. We also ate out twice and spent $107.45 on restaurants. I also spent $45 on Starbucks. Yes, I’m spending money on lattes!

Pets – $410.03

We took our furbaby to the vet again for some skin issues. It is getting a bit expensive but she is also getting old and these expenses are probably normal for her age. We’re hoping that it clears up and we can get to the bottom of it.

Kids – $300

We decided to stop contributing to the kids 529 plan. $200 is for one kid. We also spent $93.11 for the trampoline playground. Not worth it, in my opinion. The kids are just too young for it and it was expensive. The rest are for supplies for AHP’s coop that I donated.

Utilities – $265.52

These are for water, sewer, garbage, cell phone and last month’s subscription to HBO Max. It looks like we’ve been using 2gbs of data on average and our cell phone bill is now normally $29.29.

Home – $116.4

This is for one month of HOA. We paid for a late fees because it was on an auto pay from a bank account that we closed.

Auto and Transport – $106.37

3 trips to Costco for gas and $40 for my carpool for the month of January and March. I prepare taxes for VITA and carpool with my neighbor three times a week. It’s a fun retirement job and I get to do it with my retired, 74 year old neighbor.

Shopping – $18.10

Subscription fees for Amazon, which we mainly use for music. I also bought some sunnys for the kiddos, for one week when the sun came out!