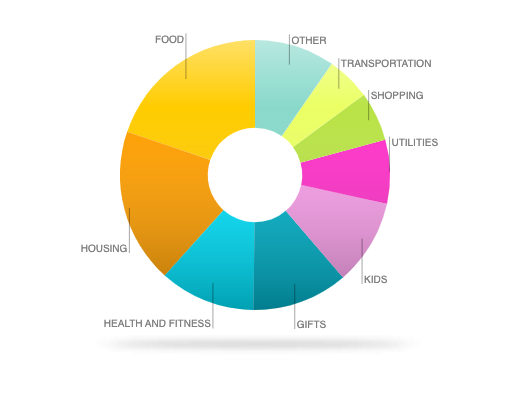

We finally reviewed our annual spending for our second year of retirement. In total, we spent $52,061.21. This is 23% more than our spending in 2020, up from $39,955.36. The increase was primary driven by our health insurance. We sold our rental condo in 2020 and we paid the full amount of health insurance through marketplace.

We started to seriously consider early retirement back in 2018. We thought about it, shortly after MBP was born in 2017. In early 2018, we assessed our assets and current spending. My husband came up with a monthly spending budget of $4,618 or $55,416 annualized. We never reviewed our spending on this initial budget once we retired in 2019, but successfully spent below that in the last two years.

So where did our money went?

Food – $10.189.79

I wasn’t surprised that this was our biggest expense. The biggest chunk of this spending were for groceries. We followed a plant based diet, for majority of our meals and we think that there can be some room to decrease it. We will not limit ourselves, but will be more cognizant of the prices.

We also ate out this year or ordered a to go meal. We can easily spend $100+ on one restaurant meal for a family of 4. So this was probably acceptable. I do want to limit our fast food visit. It’s just not healthy. Alcohols and bars, were just alcohol from groceries that I categorized separately, similar with junk food. And I apparently went to Starbucks last year.

| Description | Amount |

|---|---|

| Groceries | 8,528.07 |

| Restaurants | 993.70 |

| Fast Food | 428.27 |

| Alcohol & Bars | 121.92 |

| Junk Food | 101.40 |

| Coffee Shops | 16.43 |

| Total | 10,189.79 |

Housing – $10,133.08

We do not have a mortgage, but housing is still expensive. We spent over $6k on property taxes last year and I expect this to go up once the county completed there assessment. We’ve been thinking about moving somewhere closer to MBP’s school to an area that do not have an HOA, but the housing market is so nuts! The house prices there are comparable to where we live so we’re not necessarily saving. We’ll see if we can do it this year.

We also added a new mattress and a new to us couch for the kids playroom. We hired someone to clean our roof and gutters, our home insurance went up and we bought some things from Home Depot or Lowes that were accounted as Home Improvement.

| Description | Amount |

|---|---|

| Property Tax | 6,244.80 |

| Furnishings | 1,183.57 |

| HOA Dues | 876.00 |

| Home Services | 834.83 |

| Home Insurance | 707.22 |

| Home Improvement | 286.66 |

| Total | 10,133.08 |

Kids – $5,297.31

In theory this could be lower because we included our 529 Plan contribution as an expense. We are adding this contribution because we are hoping that there will be no significant increases in our spending 12-13 years from now (or at least nothing more than the adjusted inflation) Both kids have their own plan and we only contribute $200 each account. This should be $4800/year going forward since we just automated AHP’s contribution.

I’m also expecting an increase in preschool tuition next year. AHP will start his toddler class in our Coop and MBP will go to a different preschool in preparation to kindergarten. MBP’s tuition will more than double for the year because he will no longer be in a coop.

The rest were small items that may or may not be needed. We just didn’t pay enough attention to this. But hey, maybe next year, we will no longer Baby Supplies, because those were all disposable diapers that the boys still uses at night. One can dream, right?

| Description | Amount |

|---|---|

| 529 College Fund | 3,200.76 |

| Preschool Tuition | 1,228.04 |

| Kids Activities | 371.68 |

| Baby Supplies | 158.25 |

| Kids Gadgets | 149.43 |

| Hair | 61.9 |

| preschool expenses | 57.07 |

| Entertainment | 55.88 |

| Toys | 14.30 |

| Total | 5,297.31 |

Health and Fitness – $5,905.89

Major factor of our increase spending was our Health Insurance Premium. We didn’t get a subsidy in the beginning of 2021 and then CARES act provided some subsidy. I will need to check our tax bill this year to ensure that we didn’t overpay or underpay.

We also went back to the YMCA this summer. I enrolled MBP in a swim class last summer and the cost was similar to the monthly membership at the Y at $145/month. The monthly membership is for the entire family and includes swim classes for the boys, if we actually enroll them. So far, we’re just going as a family and I go by myself at least 2x a week.

My husband and I also pay for our dental cleaning out of pocket since we opt out of insurance. The cost was $140 per visit for cleaning and exam. I went once last year and my husband went twice. I also had my eye exam and purchased an annual supply of contact lenses. I also needed new glasses since my eye prescription changed.

Gifts – $5,901.33

Similar to last year, we gifted my parents some cash for Christmas. This was the big chunk of the gifts. The rest were for my immediate family and my godkids. There were also some gifts for birthdays.

| Description | Amount |

|---|---|

| Christmas Gifts | 5,404.27 |

| Gift | 497.06 |

| Total | 5,901.33 |

Utilities – $3,914.3

This price was consistent to last year. This year, I also started paying extra to offset my electric and gas or to purchase clean energy. Puget Sound Energy has an option for their consumer to pay more to use clean energy. For a month, it was only an extra $3-6 depending on our consumption. I reviewed some comparison of our home to other energy efficient, and we were pretty efficient.

Sewer was billed at a flat rate per single family home regardless of water consumption. Our water cost was also lower in comparison to other city. Our unincorporated county gets water from Tacoma and the cost are lower than the closest city we’re at. Internet was pretty normal, although I already received a letter suggesting that rates will increase next year. I also expect some increase in garbage next year. Cell phone was super low for $246.56 annually for 2 lines. We still uses Xfinity Mobile and uses about 1GB per month. There were only 4 months that we used 2 GBs.

| Description | Amount |

|---|---|

| Electric and Gas | 1,248.37 |

| Sewer | 746.67 |

| Water | 620.50 |

| Internet | 556.34 |

| Garbage | 495.86 |

| Mobile Phone | 246.56 |

| Total | 3,914.3 |

Shopping – $3,046.8

This cost was a catch all of every item we bought. Some stuff, we itemized, like my husband’s new desk. My husband also bought a new computer monitor and I bought a 1TB hard drive for my MacBook Air. I’m hoping that my laptop last another 5 years. The rest were just stuff. I think I have one purchase at Amazon that we didn’t use, which I think was a waste.

| Description | Amount |

|---|---|

| Shopping | 1,084.95 |

| Electronics & Software | 849.38 |

| Household Supplies | 311.73 |

| Nick's Desk | 319.66 |

| Clothing | 297.29 |

| Toiletries | 60.30 |

| Home Supplies | 52.8 |

| Subscription | 32.75 |

| Shoes | 28 |

| Books & Supplies | 5 |

| Office Supplies | 4.94 |

| Total | 3,046.80 |

Transportation – $2,716.91

Unlike 2019, we ventured out in 2020 and went camping for 8 nights. We visited 5 campsites last year – 4 in WA and 1 OR. This means that we drove quite a bit during the summer. My husband also went back volunteering to teach Computer Science at our “local” high school and I swim at least twice a week. We live far from these places so we drove often. Part of the reason we were thinking of moving was to lessen our commute. If we’re successful, maybe this will decrease. If not, this cost will probably be consistent, until our area is somewhat develop — maybe in 10 years.

Our auto registration and insurance increased. Our state based this on the value of the car and apparently our Prius was valued more in 2020 than in 2019. The rest were for new tires, a violation ticket, license renewal, car wash and oil change. We also paid for parking when we were in Seattle.

| Description | Amount |

|---|---|

| Gas & Fuel | 1,015.23 |

| Auto Insurance | 539.00 |

| Auto & Transport | 440.23 |

| Service & Parts | 389.70 |

| Auto Registration | 326.25 |

| Parking | 6.50 |

| Total | 2,716.91 |

Disney – $1,369.45

Our trip to Disney was technically this year, but I purchase majority of the expense last year, including our tickets, car service and rental gear.

Entertainment – $1,354.04

My husband plays hockey and the education was for my annual subscription of CPE education for my CPA credentials. I might be able to get some free CPE credits this year, so this should decrease or perhaps be semi-annually. I also paid to rent the new 007 film and purchased 2 months worth of Apple TV subscription to watch Ted Lasso. The only thing that was valuable to add was the Music that MBP purchased from Alexa. We’re lucky he only purchased one.

| Description | Amount |

|---|---|

| Hockey | 935.73 |

| Education | 149.00 |

| Entertainment | 76.53 |

| Sporting Goods | 81.59 |

| Hobbies | 36.86 |

| Travel | 35.00 |

| Movies & DVDs | 21.87 |

| Books | 13.09 |

| Subscription | 10.92 |

| Music | 4.37 |

| Total | 1,364.96 |

Pets – $852.35

Pet supplies and the cost of the annual exam for our Corgi. She’s almost 7 and is officially an adult dog. We’re lucky there were no emergency exam needed this year.

Camping – $814.7

This year was our first year tent camping. We purchased all our equipment including tents, sleeping pads, sleeping bags and cooking gear. I tried to get some of it used and I might return some of our sleeping pads purchased from Costco. We spent 6 nights at state parks and 2 nights at Kamp of America Campground in Oregon. We went to KOA during their member appreciation day and we received the 2nd night for free. The rest are some foods / groceries / games that we consumed while at the campsite.

| Description | Amount |

|---|---|

| Camping Site | 250.01 |

| Camping Gear | 409.52 |

| Food & Dining | 100.00 |

| Entertainment | 43.73 |

| Groceries | 9.24 |

| Total | 812.50 |

Vacation – $218.62

We spent one night in Great Wolf Lodge before MBP’s school started last September. This was the cost of the night stay including the arcade games.

Misc – $335.72

Some miscellaneous items like bank fee. We opened 4 new credit cards this year in preparation for our trip to Disney. Christmas cards includes the Groupon photography session and cards ordered from Canva and my annual hair cut.

| Description | Amount |

|---|---|

| Bank Fee | 199.25 |

| Christmas Cards | 55.97 |

| Hair | 40.50 |

| Personal Care | 40.00 |

| Total | 335.72 |

Overall, 2021 was a great year. We enjoyed the outdoors and surprisingly enjoyed tent camping. Spending wise, we could probably be more efficient in terms of tracking our “shopping”. It’s so easy to just buy things online.

2022 started with great with our vacation. I’m already looking forward to more vacation and more things that we can do before MBP goes to kindergarten.