It has been 6 months since we officially quit our W2 employment, called ourselves “retired” and moved out of the city. We are financially prepared and has been very conservative with our estimates. I’m not worried about the financial aspects going into retirement, but I was / am worried about the emotional toll that it could bring, mainly the boredom and the feeling of being unproductive. During the last 6 months, here are some things I learned about myself.

Giving up control

We decided to add an addition to our family post retirement. I am on a category of a high risk pregnancy, given that our first son was born at 28 weeks. For some reason, I thought that this pregnancy will be easier. I will have the benefit of all the medications and preventative measures that are available to have an easy pregnancy. I pictured myself doing yoga while pregnant. Well, I was wrong. This pregnancy is hard. From the very beginning, I felt so tired. At 22 weeks, I was advised by my doctor to take it easy and was put on modified bed rest. Our plans obviously changed. My husband stepped up and did everything to run the house, while also being the primary care taker of me and our toddler. I tried to help out as much as I can, but I was paranoid on every contraction that I felt during the second trimester. It was such a relief when I completed my 28 weeks of pregnancy, knowing that a good prognosis is on our side if I give birth. I have to be very flexible and gave up control. There are certain things that I wish I could do, but I listen to my body instead. I nap when I needed to nap. I stopped any activity that caused contraction. I stayed still. So in the last 6 months, I didn’t really do anything “productive”. I had a plan to carved out some time start a business, be engaged in my son’s school, get to know our neighbors and be active in the FIRE community. None of it happened. My husband was doing really well hitting the gym everyday, but that stopped when he has to take on all the work here at home, taking care of me and our son.

Psychological effect of “lack of income”

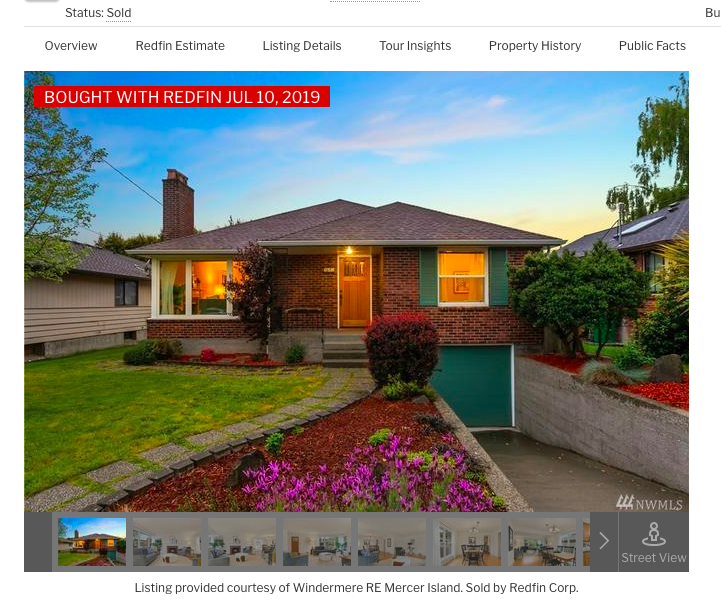

As I mentioned before, we were very conservative on our estimates when we retired. Our paid off house and a rental condo was not even part of our “portfolio” when we calculated our need for the retirement fund. I know this, but it still stings knowing that I don’t have any money “coming” in. Our portfolio grew even more, thanks to the market, but our “cash” is decreasing. We expected this, obviously. There are certain things that helped, like the higher than expected dividend income that we received this year. It also helped that we have a pretty good cash buffer and the fact that we are actually spending less than I expected. After this 6 months, I’m more relax. I even shelled out $900+ for a new iPhone 11.

We really don’t need a lot

My husband and I have some discussions regarding things that we will do if we really have a LOT of money. I’m talking about hundreds of millions here. I’m still not sure if I like living the suburbs so my thought is to go back to the city, buy and live in the house overlooking the water. I then gave some real thoughts about it. We’ve been somewhat there. We lived in a neighborhood surrounded by million dollar homes. Our son attended his first toddler class in this neighborhood. We attended a fundraising event that auctioned an “art” made by a toddler for thousands of dollars. It’s insane! We have a fairly high income and can definitely be part of the crowd, but it is not “us”. After 6 months of tracking our expenses post retirement, I can tell that we are definitely not part of that crowd and I’m happy with that.

I started this new year turning a year older this January. I’m not sure how this will unfold. I do know that flexibility is the key on sustaining this early retirement lifestyle while parenting our two toddler. I’ll still have goals, but I will just be ok if majority of it never happened. That is the beauty of retiring early, having that flexibility to stop when needed.