We spent 9 days in Oahu for Spring Break. It was the longest flight that the kids have taken. I started planning this trip a year out. I booked the hotels, on points once I know that dates of the kids break. Being in Seattle, most families spends their break in Hawaii (or Mexico) and I know that it will be a high season. For this trip, we spent $2,483.30. It is low because our flights, hotel and car rental were all booked with points. Without these, we will probably need to add an additional $5k on that amount.

I am also officially retired again. I completed my second year, managing a Tax Site for VITA. It was a pretty good and a very relax gig. Our site was not as busy as my previous tax site, but I prefer that. I never felt “taxed” coming home. We had our end of year celebration at a local Mexican place. The food was better than I expected and the company was great as well. I hope that majority of my volunteers come back.

We also attended AHP’s friends birthday party. We are at a point that we are attending more of our kid’s friends birthday party than hanging out with our own friend. That said, it is nice to see some families at our previous coop. Lastly, MBP’s campfire troupe had a Pinewood Derby at our local park. He had a lot of fun decorating it and looking at the brackets. He narrated what’s going on for everyone.

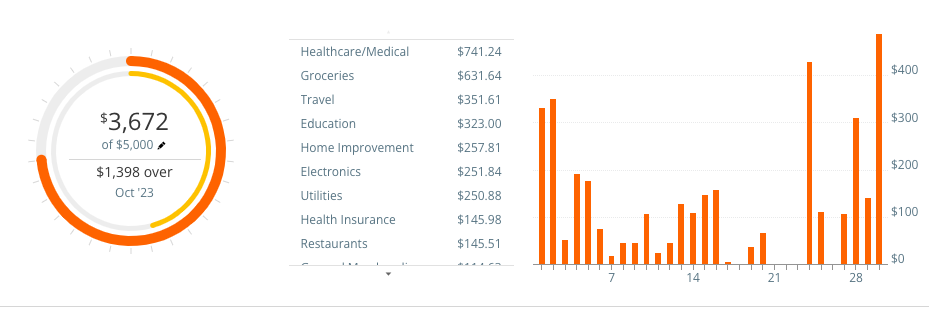

This month, we spent $4,958.09. It’s about time that we spend more than $4k. Let’s take a look.

| Description | Amount | |||

|---|---|---|---|---|

| Travel | 1669.16 | |||

| Healthcare/Medical | 714.79 | |||

| Groceries | 488.48 | |||

| Home Maintenance | 382.55 | |||

| Education | 323 | |||

| Pets/Pet Care | 229.69 | |||

| Utilities | 210 | |||

| Automotive | 178.25 | |||

| Clothing/Shoes | 137.21 | |||

| Gasoline/Fuel | 118.77 | |||

| Home Improvement | 101.58 | |||

| Kids Activities | 97.3 | |||

| HOA | 84 | |||

| General Merchandise | 65.16 | |||

| Gifts | 55.53 | |||

| Charitable Giving | 41.3 | |||

| Alcohol | 17.55 | |||

| Mobile Phone | 17.2 | |||

| Internet | 13.92 | |||

| Dues & Subscription | 7.65 | |||

| Service Charges/Fees | 5 | |||

| Total | 4,958.09 |

Travel – $1,669.16

This is the amount of money we spent in Hawaii during our trip. We spent $444 for a valet parking in our hotel. I could have parked next door and spend half the price or even less, but I like the convenience. I drove around the block with the intention of parking on the next door garage, until I realize that it is not worth it. At least not to me. I prefer the convenience of having the car in front waiting for us once we are ready for the day’s adventure. Even with this cost it didn’t really break the bank. I also find myself “spending” and fighting my nature to be frugal on everything. We ate out for dinner on all nights except for one where we order in a pizza. I had the best poke bowl and the best ramen in front of Waikiki. Yes, those are expensive, but it is ok. We spent $40 on 1 coconut and 2 mangoes from a street vendor on our way from Kualoa Ranch. That is also ok. I actually prefer to spend my money giving it to the hands of locals. Oahu, just like any other cities in the US, are not immune to social issues even though they are living in a paradise. You can tell that there are parts that are pretty run down. If you look at Waikiki, I’d be willing to bet that majority of the people who own the condos were not locals. This means, that the money doesn’t really stay in the community. When you look at houses in Oahu, the school rankings around it are very low. I feel that Hawaii is a playground of folks living in the West Coast (mainly California) or Japan. The rest of our spending was for food, transportation, souvenirs and tips. I paid for our GoOahu Pass in the previous month, so it is not here.

Anyway, I’m already planning our trip back next year. This time in Maui. I’m getting better at getting more value on our points, but Maui will be trickier. There are less hotels in the island and I’m still not sure if they are back to normal after the devastating fire in 2023. If not Maui, perhaps Florida coast.

Healthcare/Medical – $714.89

We are still paying some bills from Mr. MMD’s colonoscopy that happened last year. The last bill was $498.8 We also paid our health insurance for $99.48, vision insurance for $5 and our dental insurance for $77.52. Our dental insurance is actually good through end of June. I bought another box of eyedrops from Costco for $20.25 and some gummy vitamins for the kids for $13.74.

Groceries – $488

This is low because our “grocery” spending in Oahu were categorized as travel related.

Home Maintenance – $382

We hired a plumber to fix our outside faucet so we can water our front yard. My hope is to xeriscape our front yard at some point. It is small, but I’m not sure if HOA will allow a no grass front lawn.

Education – $323

AHP’s preschool tuition. This will go up to $355 next year. I can’t believe it’s almost summer. One more year for him and he is off to Kindergarten.

Pets/Pet Care – $229.69

Our furbaby had vet visit for $145. We also ordered her food from Instacart (affiliate link). This is the second time that I ordered her food there. Petco has a same day delivery with in-store pricing for Instacart. They also usually run deals. I was able to stack it by buying a discounted GC at Raise (Affiliate link). I got $100 GC for $84.69.

Utilities – $210

Water, sewer and garbage. Nothing new here. Our electric and gas were paid in May.

Automotive – $178.25

Annual registration for our 2011 Toyota Prius.

Clothing / Shoes – $137

I got the boys a minimalist shoes from Amazon. AHP has a very wide feet and I’d like to keep their feet on a wide splayed shoes, zero drop shoes. I found one at Amazon that is reasonably priced and bought 2 for $72.9. I also got the 3 of us (boys and I) some flip flops from target to use in Hawaii. AHP ended up hating them and didn’t even wear it in Hawaii. I got them some toe socks as well, a biker shorts for me from Costco on sale at $10.98. Lastly, I paid $15 to consign the kids stuff at a consignment store. I think I’m getting $60 back. I’m not sure if it is worth it, since I have to tag all the items and put it in the system. That said, it is nice to finally get rid of all their stuff in one go. The Prius was packed! I can’t believe we accumulate those items, considering I’m very careful on things I buy, since I know that I need to store them somewhere!

Gasoline/ Fuel – $118.77

We gas up our Prius twice and our Jetta once.

Home Improvement – $116

Some stuff from Lowes and Costco. I think it is the soil for our garden bed.

Kids Activities – $97

4 tickets to the Tacoma Rainer’s game and painters tape from Home Depot.

HOA – $84

To pay for our playground and trails. I do hope someday it will go away.

General Merchandise – $59.61

Random stuff from Costco, Amazon and Walmart. Delta also broke a wheel on our Uppababy Vista. Luckily they reimbursed us for it. They are also very quick to respond. One wheel was $51.45. Mr. MMD also bought some games.

Gifts – $55.53

Gifts for MBP and AHP’s friends. I typically spend $20 per person for gifts. Sometimes less if I can find something interesting at the dollar store.

Charitable Giving – $41.30

MBP has another fundraiser at his school and he just need to get those key chains. We donated the minimum. I don’t mind the charity drive, but I don’t think it is teaching the kids that it is for a certain cause. MBP just want the key chains!

Alcohol – $17.55

For Mr. MMD. I do get wine from Trader Joe’s as well for my monthly book club.

Mobile Phone $17.2

We are still at Xfinity Mobile. This is for 2 lines using about 1gb of data.

Internet – $13.92

We should be getting lower internet package from Xfinity going forward.

Subscription – $7.65

Monthly Prime Membership

Fees – $5

Chase fee of $5 for the Savings Account that I opened to get the sign up bonus. I received $900 sign up bonus by opening both Chase Savings and Checking account and having my paycheck directly deposited to it. I closed it now and transferred the balance to a high yield CD. I still net positive even with the fees.

Overall spending for April is less than I expected considering we went to Hawaii.