School started for both kiddos. For the first time in many years, the house was quiet for a couple of hours in the morning. It was a little weird not having the kids at home, but it is nice to do have some time to actually do some work.

We continue to do some work around the house this September. We, really means Mr. MMD. In September, he finished putting up the shed and put the insulation back in our crawl space. Apparently, a big chunk of the insulation fell to the ground because nothing is holding it up. Mr. MMD, managed to fixed this. Hopefully, it will stay put. Other household project includes buying a bed frame for us and a new couch. I led this project and you can see this on our spending.

I used the morning time to organize and declutter. We finally got rid of the grass fertilizer and other household chemicals that were in the laundry room. Funny that we actually move those items in our new house and it took us 4 years to get rid of them. I donated some clothes and household items in Goodwill. Decluttering is really a never ending project, especially with the kids stuff.

I also had my eye examined by an ophthalmologist. It was so hard to find a doctor in my network that I actually went out of network. I’m just glad that I was seen and I’m hoping that this issue will get fix. I also started going to a Chiropractor. I started having some lower back issue when we switch mattress. I’m still having some and I’m looking for a new mattress. My insurance covers 10 visit with a $15 copay per visit. I like my insurance for that and I also like my chiro.

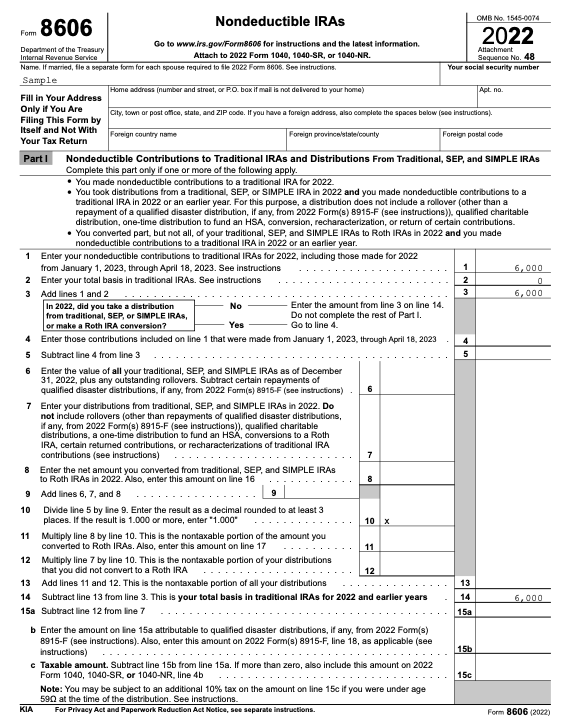

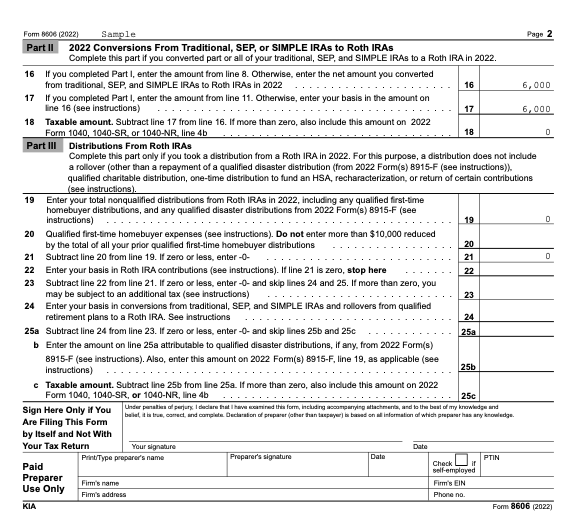

In September, we spent $11,691.21. This is huge and we are living large! I wish I can say that our spending will go down, but I can’t see this happening. We will re-asses by the end of the year. We might need to put together a budget if our spending continue to increase. Let’s take a look where we spent our money.

| CATEGORY | Spending |

|---|---|

| Home | $5,937.62 |

| Pets | $1,564.17 |

| Kids | $940.82 |

| Food & Dining | $809.39 |

| Travel | $791.20 |

| Health & Fitness | $651.45 |

| Auto & Transport | $622.72 |

| Shopping | $164.31 |

| Bills & Utilities | $126.81 |

| Personal Care | $75.44 |

| Gifts & Donations | $7.28 |

| Total | $11,691.21 |

Home – $5,937.62

The biggest items are furnishings. Mr. MMD and I haven’t bought a new furniture together. Our couch is falling apart and I’d like to have a real bed. Macy’s had a sale for labor day and we spent $3,735.04 on a sectional and a queen bed. The amount included a $299 white glove delivery. The guys came in and assembled the furnitures and took out all the garbage with it. It’s well worth the price. I listed our old couch and love seat on our buy nothing page and it was picked up the next weekend.

We also purchased our shed at Walmart for $1,289. We received a $12 credit from Chase offers by ordering on Walmart online. I also got a couple of clocks for the playroom and the living room, a dozen new glassware, flatware for MBP’s lunch box and some scissors at Ikea. I used some old gift card and spent $48.30 on the balance.

The next item under home, are Home Improvement. These are the expenses to prepare the ground for the shed. Mr. MMD rented a tamper to even out the ground. The cost is $343.51 with delivery. He also ordered some gravel which cost $307.7. We spent $146.42 for various visit at Lowes.

Last category for home is our HOA fee for $79.65.

Pets – $1,564.17

This is a fee for our furbaby’s tooth extraction and tooth cleaning. This is her second tooth cleaning since we got her and is totally overdue. Our dog doesn’t like her teeth brushed. The vet needs to give her some anesthesia for it.

Kids – $940.82

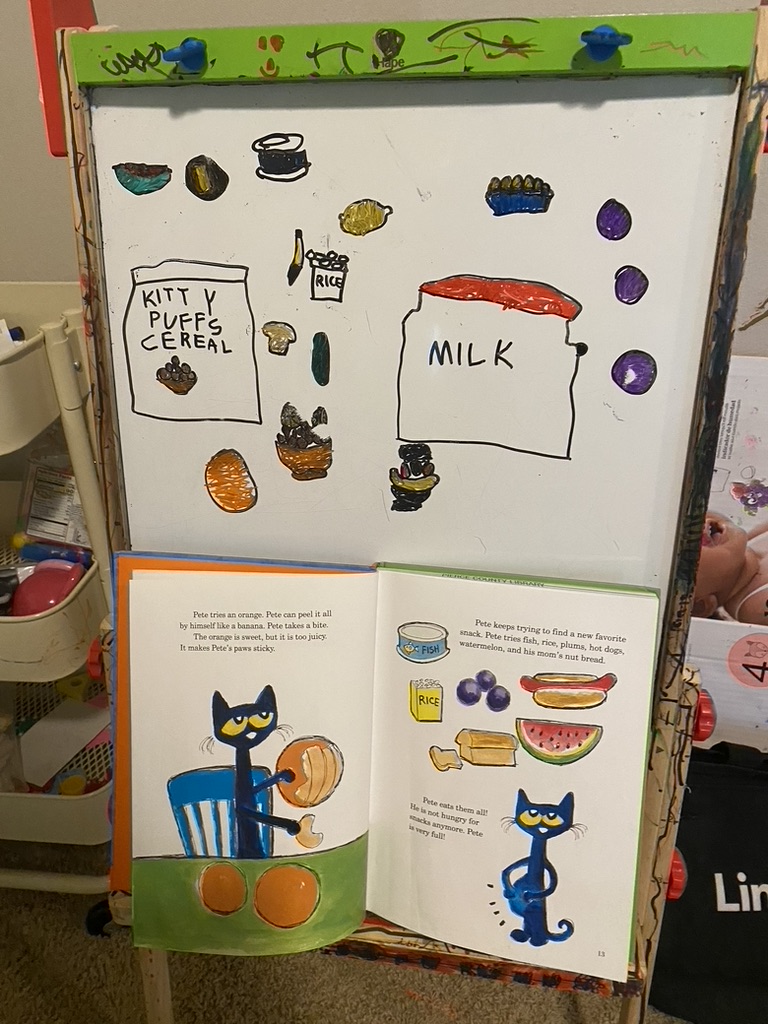

We spent $350.31 on Kids Gadget. We moved AHP out of his high chair and got him a Stokke Chair. I’ve been looking for a used one for months, but I think kids uses it for so long and I never saw a used one closed to us. I didn’t want to drive too far so I hit the buy button at Amazon, instead. It’s expensive at $261.71, but the kids are using this chair everyday. MBP’s chair is still going strong after 3.5 years of use. This is one of those items that I think is worth the splurge for our family. I also got MBP a lunch box. The price is steep at $49.22 but MBP seems to really like it. We can pack hot lunches with it from our left over dinner. The box is big enough to hold his lunch and afternoon snack. I also got AHP a new backpack for his preschool, a headphones for MBP and a rain shield for our double umbrella stroller. We’ve been walking to and from school everyday. The walk is .7 miles one way with elevation of 115 ft. He can walk to school but struggle going back because of the hills. I pick him up with the double stroller. He’ll walk until he gets tired and will climb into the stroller.

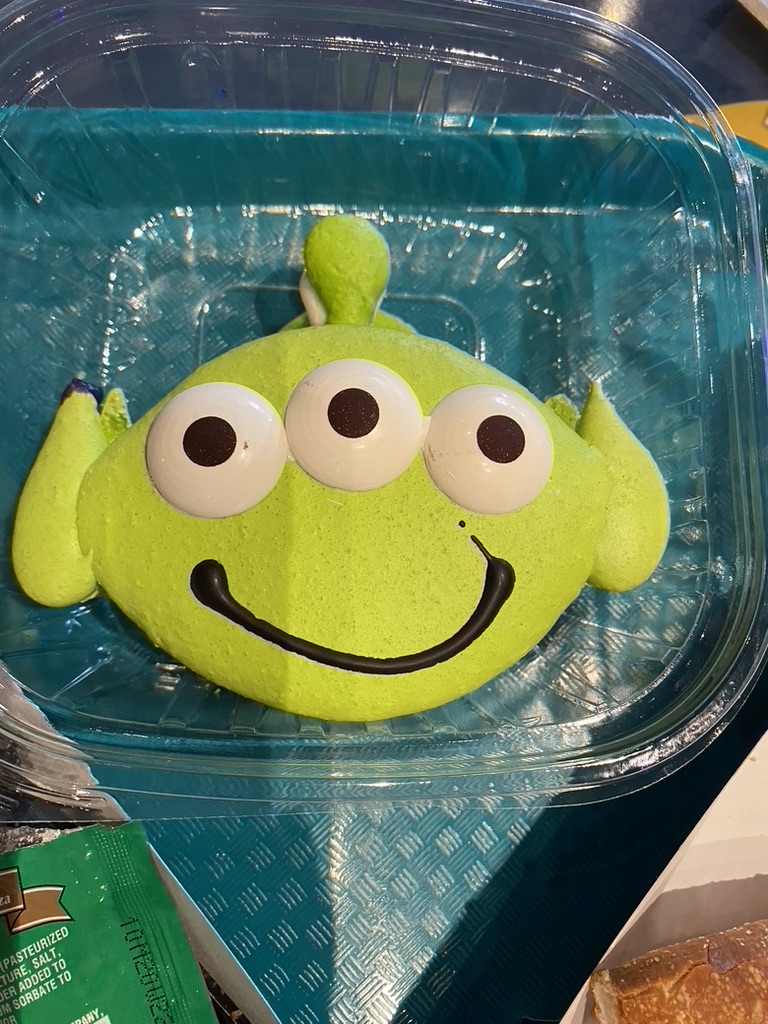

Preschool tuition for AHP is $323. We spent $176 on various kids activities. I signed up MBP for Camp Fire. It’s an after school activity that meets every other week, completely ran by parents. The fee and the vest is $78 for the year. I also paid $68 for their school photos and $30 for the pumpkin patch, which happened in October.

School is $91.51. These are various expenses related to kids school like, PTA membership fees for $20 and teacher wish list donation for the rest.

Food and Dining – $884.88

We spent $842.10 on groceries. Mr. MMD spent $38.36 for dinner with his buddy and I spent $4.42 for coffee. We actually didn’t eat out this month.

Travel – $791.2

We bought 4 tickets to Chicago to visit my in-laws for Thanksgiving. I booked a rental car from O’Hare Airport through Costco to drive to Bloomington area. There were plenty of direct flight to O’Hare from Seattle and it makes more sense to just drive to Bloomington instead of flying there.

Health and Fitness – $651.45

I’ve been having some eye issues since June. I can’t find an in-network ophthalmologist on my insurance so I went out of network. I really like my doctor and I’ll be switching to her next year. The cost of my first visit was $266.47. I also paid $30 co-pay for my 2 visits at chiropractor. We paid $154 for our YMCA membership. We never really went to the Y this September, so it will not be a recurring expenses for us until next summer. Our health insurance was $99.58 and our dental insurance was $41.40. I also paid a $50 co-pay for my dentist. Lastly, I paid $10 co-pay for my eye drop. This eye drop cost over $100 without insurance. We are definitely using our insurance this year.

Auto and Transport – $625.96

Our 6 months auto insurance was $534.37. This is for our 2010 VW Jetta and 2010 Toyota Prius. We also spent $79.55 on fuel and $8.8 on tolls from this summer.

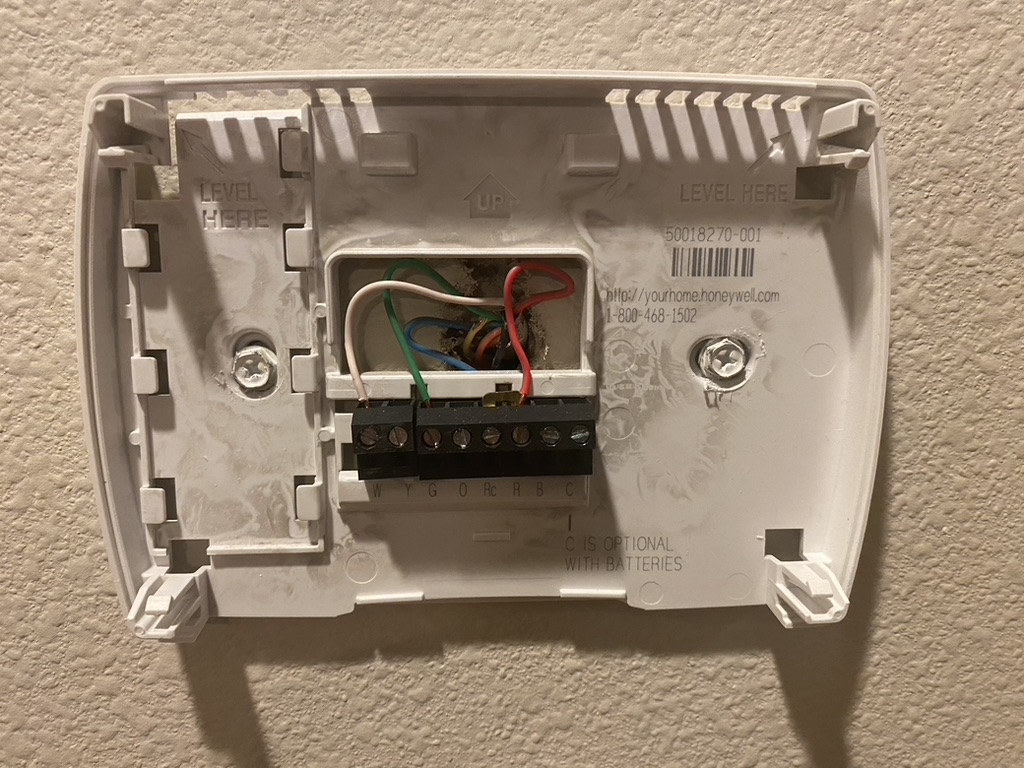

Bills and Utilities – $126.81

This is for our water at $43.39, sewer at $66.46 and mobile phone at $16.96. We are back on consuming 1GB on our Xfinity Mobile.

Shopping – $123.31

We got MBP the Super Mario Odyssey game for his switch. He is almost done with it and is now on the bonus section. The cost is $58.2. I also got him a pair of rain boots / snow boots for $43.77. This is a must in the Pacific Northwest. I spent $13.69 at Dollar Tree for sticker books and we also paid $7.65 for our prime subscription.

Personal Care – $40.95

The boys had a hair cut. This is actually cheaper because our hairdresser have a 1 free hair cut for every 10 hair cut. It’s usually cost us $60+ including tips.

Gift and Donation – $7.28

We went to AHP’s friends birthday party and this is the boy’s gift to her.