Our second son, Adam Henry or AHP completed our little family on February 15, 2020. I made it to term at 39 weeks and 3 days. AHP was born at 7 lbs 12 ounces and 20.5 inches long

As of this writing, we already survived one month with 2 kids, and a month of sleep deprivation. The chaos surrounding us with COVID-19 virus didn’t help, and it doesn’t seem to have an end.

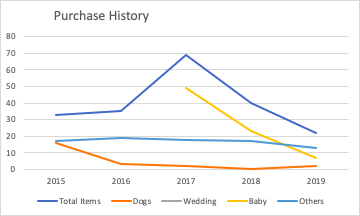

In February, we spent $2,192.44

Food – $599.34

Food is our highest expense for 2 months in a row. We ordered some takeouts while I was in the hospital. It includes a take out from Burger King, right after I gave birth and a take out from an Asian Restaurant for dinner during the night that I spent in the hospital. Aside from those, our meals were cooked at home. We spent $566.86 in groceries. $301.33 were spent in Costco and $223.93 were spent in WINCO. The rest were scattered between Fred Myer and Walmart.

Utilities – $366.04

We paid for garbage and water this month. Both were paid bimonthly.

Doctor – $193.05

We chose to circumcise AHP. The procedure was elective and not covered by insurance. I was surprised of the cost. My quote from my OB office was about $400. I found out that AHP’s pediatrician does it and we chose her to perform the procedure instead of my OB office. Our pediatrician is local and we will be able to save the drive. I didn’t even asked for a quote. I was prepared to pay upwards of $400, but was happily surprised when the receptionist told us the price. My husband and I looked at each other because it cost half of the quote I received from my OB’s office. It was also half of the cost the the insurance paid for MBP’s circumcision.

Baby Supplies – $184.9

We bought some newborn diapers, size 1 diapers, diaper cream and a formula for AHP. I supplemented with formula because my milk didn’t came in until day 4. We bought diapers since the size of our cloth diaper will not fit AHP until he is about 10 lbs. Our plan is to get through the size 1 diapers and the switch him to cloth diapers. The baby supplies also included some bottle nipples and saline solution for MBP. Shortly later, we were able to convince MBP to give up his bottle and drink his milk straight from the cup. Win win win here. He is also doing well on potty training and is only on diaper at naps and bed time.

Furnishings – $99.4

We bought this at Amazon for the guest room / my husband’s office. We thought about a murphy bed for the guest room / office, but it didn’t make sense. Murphy beds will cost more than our current bed and will be used 10+ days in a year when my in-laws are here. We got this bed so we can fold it and keep it in the closet along with the mattress whenever we don’t have visitors.

Shopping – $71.19

Mr. MMD bought some crocs, socks and dry erase markers.

The rest were some routine monthly expenses like HOA, Gas, Cellphone and Prime Subscription. Gas expenses was down this month since we didn’t go anywhere. We also received a discounted membership for Prime since we are eligible for Apple Healthcare. Cellphone bill is cheap at $16.12 for two lines from Xfinity Mobile.

Overall, expenses remain low. I will never forget the month of February with the birth of AHP, the artificial highs in the stock market just to see it plummet in a couple of weeks.

And here’s our expenses for February 2020. I hope you are all doing well. Take care, wash your hands and practice social distancing.

| Description | Amount | Comments |

|---|---|---|

| Food | 599.34 | |

| 529 College Fund | 400 | |

| Utilities | 366.04 | Electric, Gas, Sewer, Water and Garbage |

| Doctor | 193.05 | |

| Baby Supplies | 184.9 | |

| Furnishings | 99.45 | |

| Shopping | 71.19 | |

| HOA Dues | 68.25 | |

| Preschool Tuition | 60 | Registration fee for MBP's school next year |

| Gas & Fuel | 48.48 | |

| Pet Food & Supplies | 36.78 | For our very spoile baby fur |

| Personal Care | 23.19 | Some lotion |

| Household Supplies | 18.53 | |

| Mobile Phone | 16.12 | This is dirt cheap through Xfinity mobile |

| Subscription | 6.55 | |

| Electronics & Software | 0.57 | |

| Grand Total | 2,192.44 |